Menu

Environment

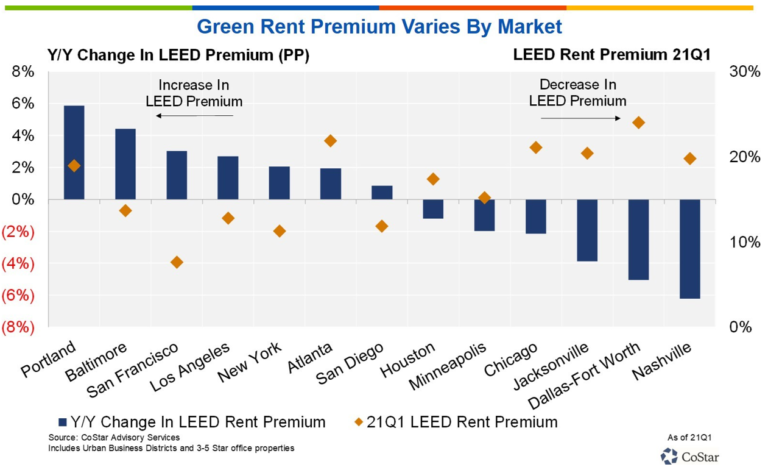

Green Office Buildings

Green Office Buildings: Greater Demand, Higher Rents, Reduced Costs, Less Risk, Lower Cap Rates, Maximum Value This whitepaper is based on an article published by ...

June 3, 2021

Social

Expanding S. Who Now?

The Commercial Real Estate (CRE) industry has been slow to fully embrace Diversity, Equity and Inclusion (DE&I). One explanation, from our point of view, is ...

May 6, 2021

Social

What If? What Now?

Amanda Gorman's poem read at President Biden's inauguration.

January 30, 2021

Investment

Increasing Importance of ESG Investment Strategies

Real estate investors across the board are showing more interest in sustainable platforms. ESG may not yet be in our everyday vocabulary when it comes ...

January 14, 2021

Environment

Why E3SG? Why Now?

ESG is the fastest growing, most impactful new development metric in the global investment community, directly tied to the UN’s Sustainable Development Goals (SDG’s), now ...

December 5, 2020

Subscribe to Learn More from the E³SG Team.

Stay up-to-date with all the latest news from the CRE and ESG industries.