This whitepaper is based on an article published by Nancy Muscatello and Alexander Levy of CoStar Advisory Services on May 11, 2021. The focus of the article was the increase in leasing activity in terms of the pandemic and people now returning to their offices, but the most significant conclusion as it relates to E³SG Analytics is that “green buildings achieve higher rent and pricing premiums” when compared to their peers.

Currently, user focus on health and sustainability is driving this outperformance. But green office buildings have historically achieved higher rent and pricing premiums relative to their peers, and that premium has grown since the pandemic began. Tenants are increasingly thinking more and longer term about the role their commercial real estate footprint plays in improving environmental, social and corporate governance, or ESG, metrics.

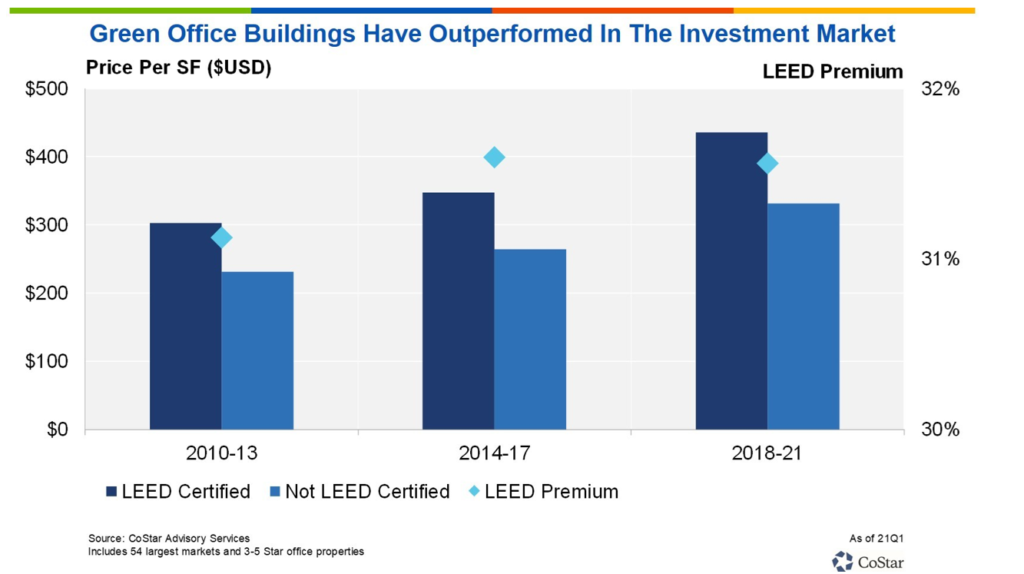

The significant rent premiums achieved by green buildings have led to outperformance of their peers in the investment market. Capitalization rates on LEED-certified property transactions have trended 70 basis points lower on average than noncertified properties in the same geographies over the last 10 years, leading to a 31% sales price per square foot premium commanded by those green buildings. Further, annual price growth for LEED-certified buildings has averaged 6.2% versus 4.7% for nonrated office properties of similar quality since 2010, demonstrating the strength and impact of investor demand for green buildings.

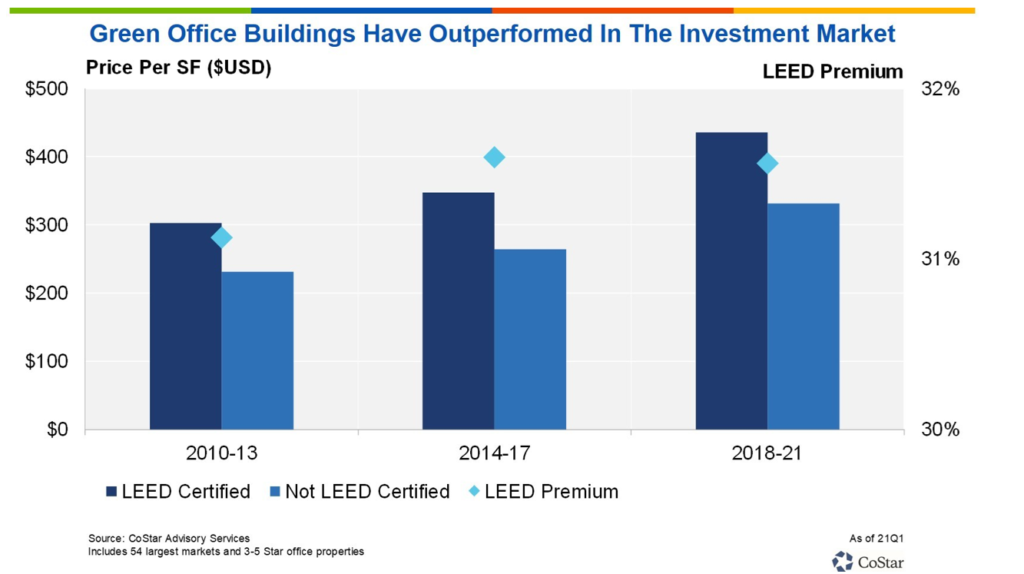

Green-rated office buildings have long commanded substantial rent premiums over comparable nonrated buildings, and that trend has held throughout the pandemic. The benefits that green certification offers allowed landlords to increase rents at a higher rate during the expansion years of the past cycle, while also mitigating some of the downside impact during the period of market stress over the past 12 months. While national office asking rents declined 1.8% over the last year in the three- and four- and five-star segment, rents in similar quality green buildings showed a modest uptick of 0.4%.

Furthermore, the rent premium achieved by office buildings that have achieved Leadership in Energy and Environmental Design, or LEED, certification by the U.S. Green Building Council over their noncertified counterparts continued to increase during the pandemic, particularly in urban areas. LEED certified office buildings have demonstrated a consistent outperformance over the course of the past cycle, and tend to skew toward higher-quality properties, and for this reason represent the primary E focus of E³SG Realty Investments. Roughly 10% of the office inventory rated three stars or higher is LEED certified, while very few one- and two-star properties have achieved LEED certification.

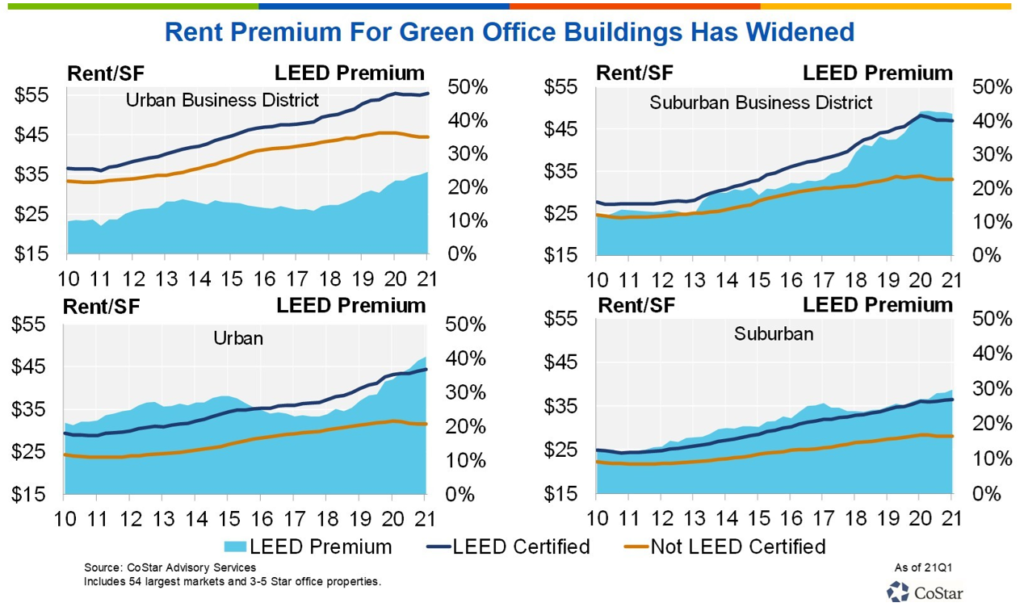

Historically, the LEED premium has been lowest in urban business districts, given the higher share of top-quality buildings in these areas, but LEED premiums in downtown cores rose from 22% in the first quarter of 2020 to 24.6% in the first quarter of 2021. Similarly, in urban areas outside of downtown cores, rent premiums rose 6 percentage points to over 40% in the first quarter of 2021. Suburban business districts maintain the widest premiums at 42%, while in less dense suburban areas, the LEED premium has widened as well to 30% over the past 12 months.

Until recently, green has largely been considered an amenity. E³SG contends that green is now firmly part of the whole ESG equation and no longer an amenity, but a requirement. The increased market focus on ESG issues is rapidly accelerating the shift to a more sustainable and energy-efficient office environment. Furthermore, tenants have many and varied choices in the office market today and those assets that address concerns around health and sustainability, and are in desirable locations, should continue to maintain, or even grow, their green advantage in the coming years.

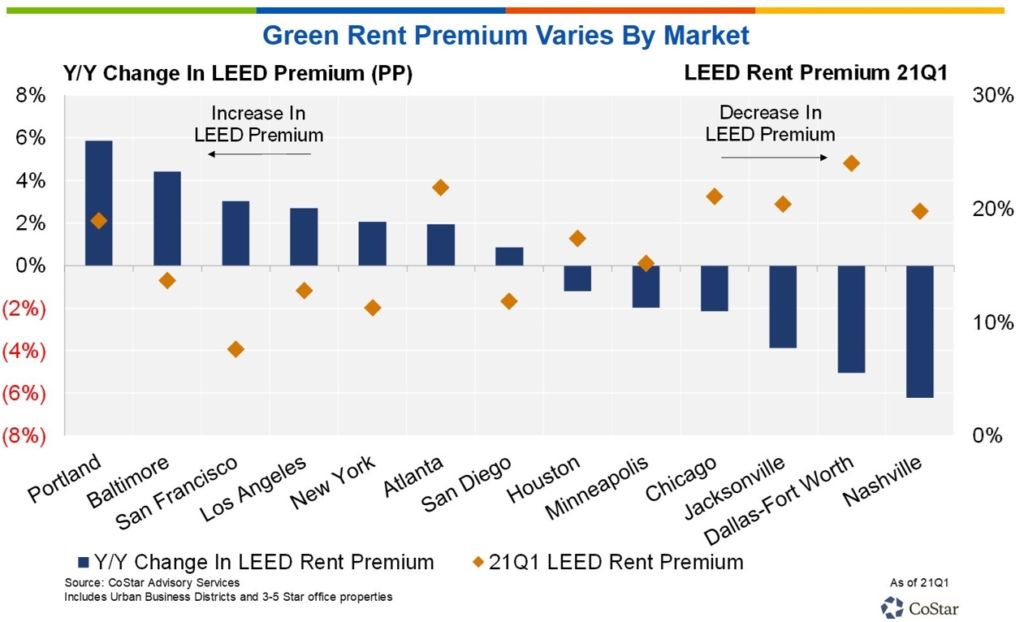

In this regard, one of the biggest changes seen in recent months relates to the out-migration from urban core in gateway cities to 2nd and 3rd tier cities, suburban, and even rural, markets. As a result, as shown in the following CoStar exhibit, the change in rent premium over the past year has varied importantly by market. Looking within urban business districts only, secondary cities including Portland, Atlanta, and San Diego have shown some of the largest increases in the rent premium for green buildings. In New York and San Francisco, with some of the largest declines in overall office asking rents in the past year, green building rents have not fallen as steeply, and so the rent premium for green buildings in these two markets has actually widened the spread. And even though LEED rent premiums declined a bit over the last year in some cities including Chicago, Dallas, and Nashville, the urban business districts in those metropolitan areas still garner substantial LEED premiums of over 20% compared to non-LEED certified properties.

The ability to recognize and incorporate these sustainability shifts and trends, as evidenced by the ESG variables and premiums provided in the CoStar data, into current valuation metrics is the industry-leading strength of E³SG Analytics. The technological partnerships with MIT, Enriched Data, and E³SG Technologies will allow for creation of the country’s most robust, cutting-edge, and market-focused solutions to the challenges of real estate valuation today.

Given the headwinds to office demand in the near term, with overall leasing rates still down roughly 30% from typical levels, buildings that are able to address the health and environmental concerns of users – and provide efficiencies and cost savings to owners – will be able to strengthen their long-term competitiveness. At the same time, the professional community must have the data and the ability to properly value their relative green advantages.

Urban areas (where there is the greatest national demand, and therefore the least operational and transactional risk) account for the overwhelming majority of green office buildings and also have the highest concentration of buildings that achieved either gold or platinum certification, the two highest LEED ratings. A higher certification level is associated with more rigorous benchmarks in categories such as energy efficiency, indoor environmental quality and building materials efficiency among others. These often lead to higher long-term cost savings for the building owner as a result. As expected, a higher certification level is also associated with a higher rent premium. This explains the E orientation of LEED-certified assets in the current E³SG Realty Investments portfolio.

Get in touch to see how we can help you diversify your portfolio in a sustainable fashion.

Contact Us