Working with the Innovation Lab at MIT as our technology partner, E³SG is creating an innovative program to generate and organize for distribution every transactionable ESG property in the country, and to generate long-term value as fiduciaries for our investor clients. The product is being developed with an exclusive focus on only those real assets that allow investors and users to achieve their mandates, goals, and objectives in terms of financial performance, sustainability, and diversity and inclusion. The framework is based on a much-expanded version of currently integrated ESG metrics and definitions.

The E³SG products and services are being created to provide direct investor access to ESG real estate assets as an alternative ESG investment vehicle. Whether self-directed or imposed by regulation, our target audience requires more investment outlets and better, standardized data to quantify sustainable benefits and returns – and is spending valuable time, money, and effort – globally, right now – to develop these opportunities.

The acronym ESG was first coined in 2005 in a paper entitled “Who Cares Wins”. Today, global ESG investing, estimated at $40.5 trillion, is growing at an approximate rate of 10-15% annually. In 2018, one in five dollars of AUM was reported as an ESG investment, in 2020, one in three.

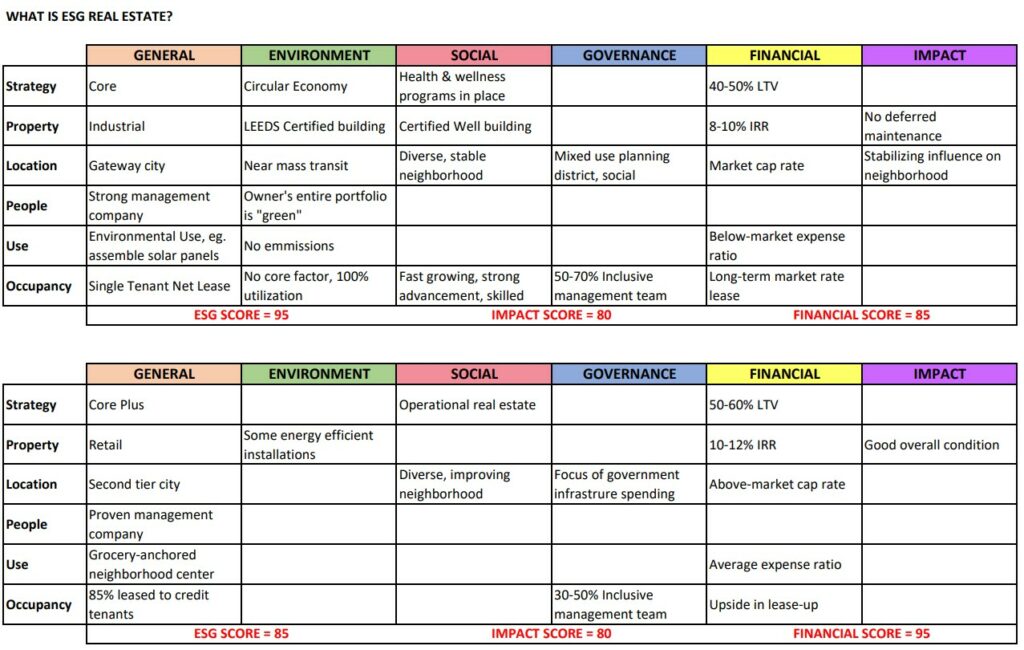

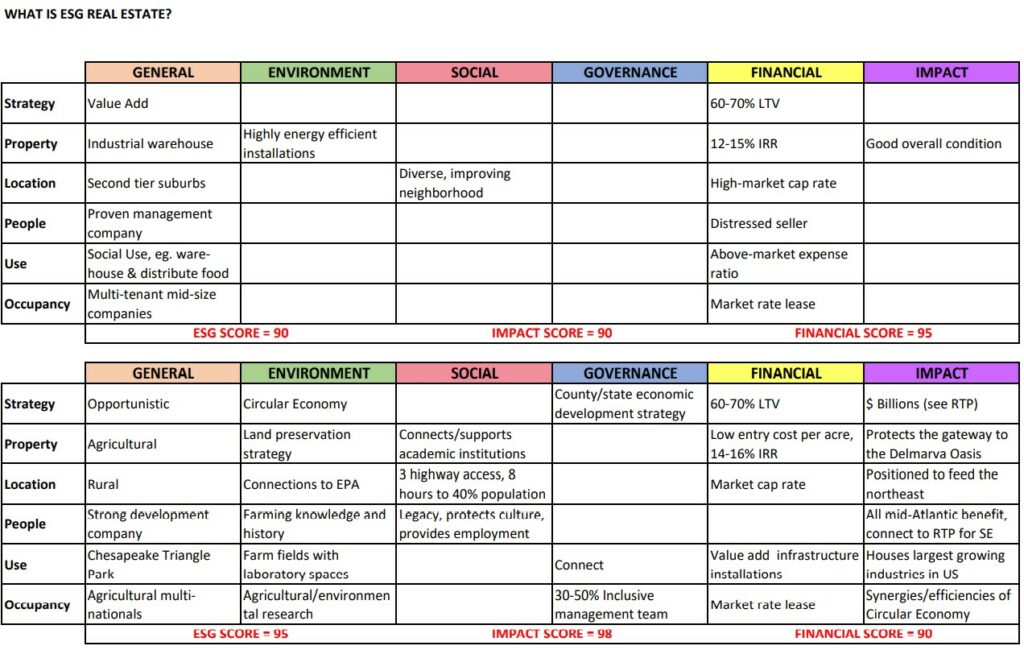

Importantly, ESG exists today primarily as a reporting – or a scoring – framework … of value drivers, measures of risk, or measures of the sustainability or ethical impact of a business or company. Great progress has been made on the people side, particularly in terms of diversity and inclusion as pertaining to social and governance. But on the property side, as big as ESG is today, the framework largely relates to the existing real estate assets of a company, with the emphasis on systems within buildings, namely energy sources, and now with the Corona Virus – HVAC and air filtration. ESG is not a stand-alone, directly investable asset type and there is no reliable, easily sourced inventory of ESG physical assets for acquisition. This is what leads to the opportunity and in the context of the accompanying chart of ESG examples, this is what E³SG Realty Investments is setting out to create.

For all the money chasing ESG and Impact opportunities, private real estate has never been identified as an alternative asset class that can satisfy the mandate on a broad scale. The market is too granular and too inefficient. Accordingly, over the past decade, as ESG has been mainstreamed and expanded exponentially, most of the capital invested has come from Wall Street and been placed in the securities of portfolio companies, not directly in real estate. ESG is largely thought of today in terms of investment in companies.

Drilling down further, to the extent investors have included real estate acquisition in an ESG strategy, they have had to do so through self-identified, locally oriented, one-offs. There is a void in the marketplace, there is no product specialization, there is no brokerage group sourcing ESG real estate assets nationally.

Further still, it is a highly inefficient and outdated characteristic of the real estate transaction process that offerings are evaluated individually, during post-contract due diligence – not (at least preliminarily) by algorithm in real time.